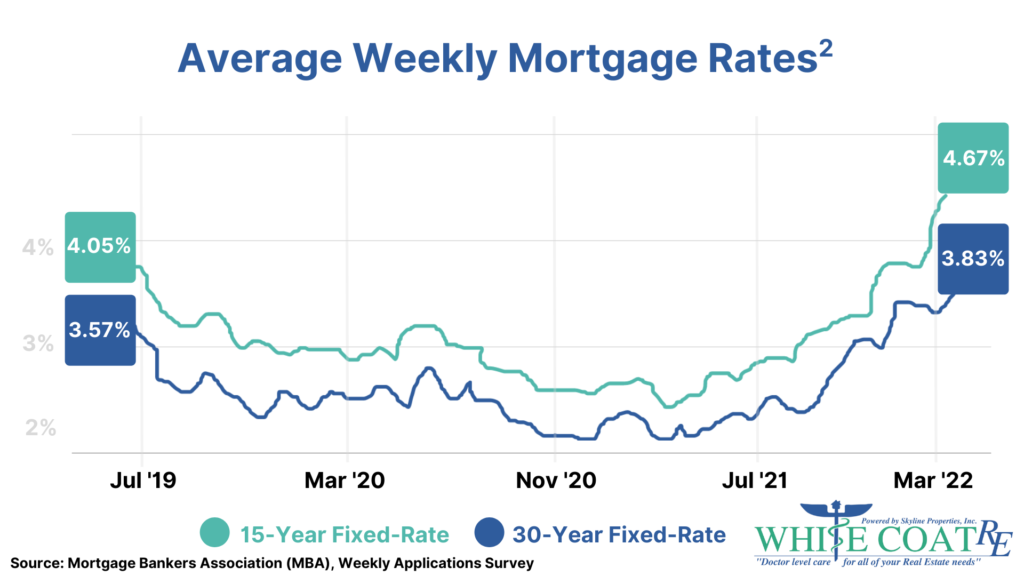

Early this year, I was helping a first-time home buyer find a home. The client was preapproved for $610k when we started searching. We were able to get into contract on one property, but the buyer got cold feet and eventually canceled the deal. We continued searching for a property however, in the span of two weeks, interest rates rose, dramatically reducing his buying power to around $560k. We found him a home, but he ended up settling for a less desirable property.

This chart shows the dramatic increase in residential mortgage rates since the start of the year. Experts predict rates will continue to rise 4 to 6 more times throughout the next 12 months.

This situation reminds me of a quote from Robert Kiyosaki in his book, Rich Dad Poor Dad:

First-time home buyers commonly make the mistake of being indecisive. Their indecision ends up hurting them as home costs continue to increase. In a rising interest rate environment, Sellers can make the same mistake – waiting too long to sell a property they don’t actually want to hold long term. As interest rates increase, fewer buyers can afford to pay higher prices so a home that might have had multiple offers and a bidding war, may only have one, or may have to reduce their asking price.

If buying or selling your home or investment property is one of your goals in 2022, it’s important not to delay. With interest rates expected to increase multiple times this year, you’re better off acting sooner than later.