Why Turnkey Properties Are Ideal for a 1031 Exchange

When investors use a 1031 Exchange, their goal is simple: sell an existing property and reinvest the proceeds into another “like-kind” property—deferring capital gains taxes in the process. But what many investors overlook is that how they reinvest matters just as much as what they reinvest in.

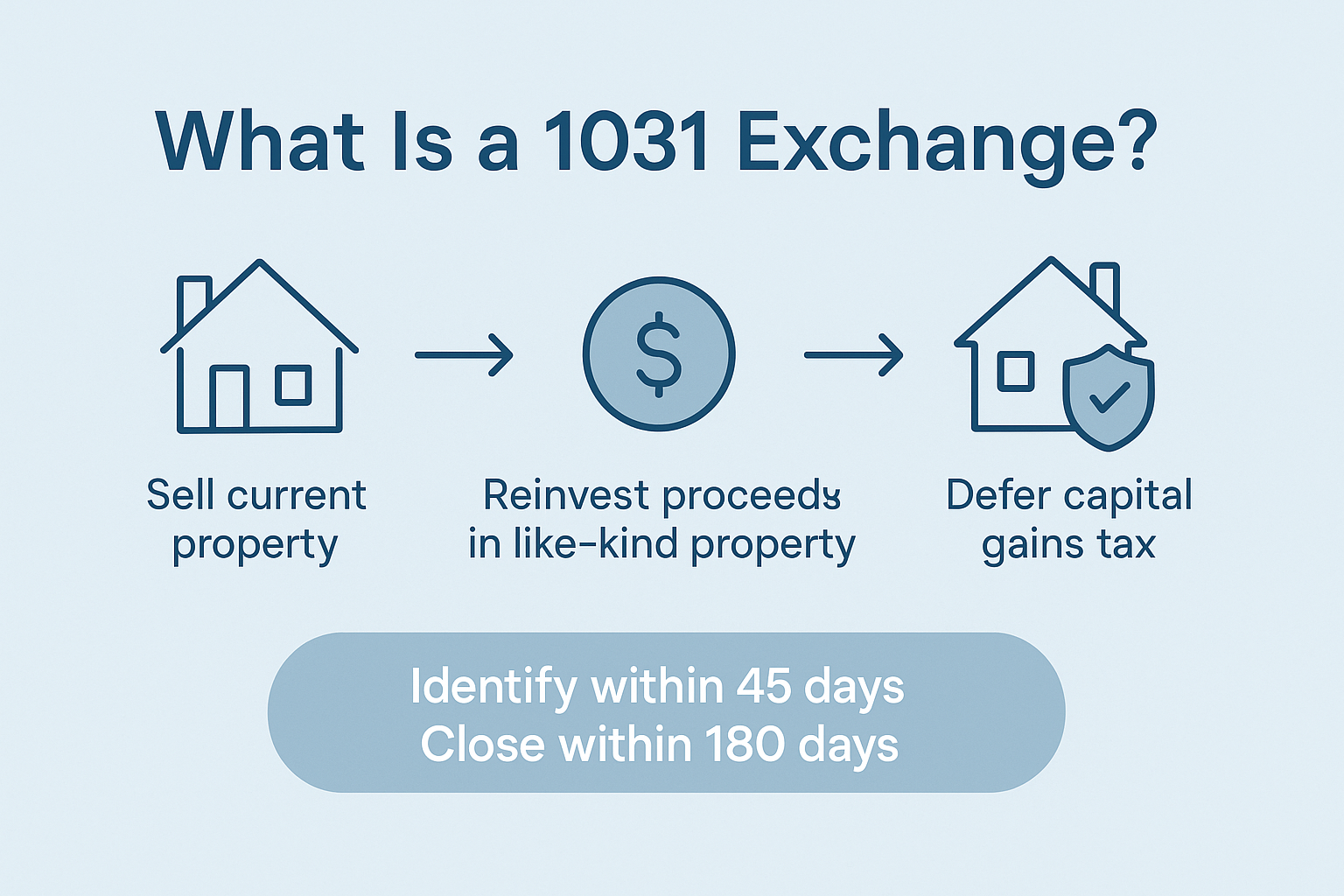

First, a quick refresher: what is a 1031 Exchange?

A 1031 Exchange (named after Section 1031 of the IRS code) allows real estate investors to defer paying capital gains taxes when they sell one investment property and buy another of equal or greater value.

To qualify, you must:

- Reinvest all sale proceeds into the new property.

- Identify your replacement property within 45 days.

- Close on it within 180 days of selling your original property.

If you don’t follow these timelines—or if you hold back any of the funds for repairs, renovations, or personal use—you could lose the tax benefits

Why turnkey properties make the most sense for 1031 investors

Many seasoned investors choose turnkey or move-in-ready properties for their 1031 Exchange. Here’s why:

1. You can reinvest all proceeds immediately

To fully defer taxes, every dollar from your sale must go toward the purchase price of the new property—not upgrades or repairs. A turnkey home eliminates renovation costs and ensures your funds are fully invested from day one.

2. You start generating income right away

Because turnkey properties are already rent-ready (and often already leased), you can begin earning rental income as soon as the exchange is complete. No downtime, no construction delays—just immediate cash flow.

3. You stay compliant and stress-free

Timing is everything in a 1031 Exchange. Renovations can push timelines, risk delays, or complicate the “like-kind” requirement. A turnkey property removes those variables, helping you meet IRS deadlines without the added stress.

4. It’s easier to scale your portfolio

Turnkey properties are ideal for investors who want to exchange into multiple units or markets quickly. Because they require less management and maintenance upfront, they free up your time to focus on identifying your next deal.

Example: a duplex that checks all the boxes

Imagine selling your out-of-state rental and reinvesting in a turnkey duplex in the Greater Seattle-Tacoma area. Each unit has in-unit laundry, an attached garage, and an open-concept layout—features that attract long-term renters and minimize turnover.

You meet all 1031 requirements, place tenants quickly, and start generating income immediately—all without a major renovation budget.

Final thoughts

A 1031 Exchange is one of the most powerful tools for building long-term wealth through real estate—but only if it’s executed carefully. By choosing turnkey properties, investors can:

- Maximize their tax deferral

- Minimize renovation risks

- Enjoy immediate cash flow

If you’re considering a 1031 Exchange and want to explore turnkey opportunities here in the Greater Seattle-Tacoma market, our team can help you identify properties that meet both your investment goals and IRS compliance requirements.

→ Reach out to White Coat RE today to learn more about upcoming turnkey listings perfect for your next 1031 Exchange.