Can you change your financial future with just one real estate decision?

Well, two of my clients just did. Some of you may have heard about a strategy called House hacking, where you buy a multi unit property. You live in one of the units, and you rent out the others to help dramatically reduce your living costs. That sounds great, but does it actually work? Well, let’s see how it worked for Greg and active military soldier and Stephanie an aspiring nurse.

Greg and Stephanie are great young couple, who like a lot of people purchased a single family home to live in a few years ago. And because they bought in a great area. Over time, their home value went up. But with inflation hitting and with Stephanie starting a new career, they both wanted to move closer to work and they also wanted to make a smart financial decision that could allow them to save more for retirement, they saw my profile on Bigger Pockets, and reached out to me.

After reviewing their goals and doing a quick financial analysis of their situation, we agreed that the best plan of action was for them to sell their home. So that way, we could free up Greg’s VA loan and also provide them with additional liquidity, then we could use Greg’s VA loan to then go out and purchase a two unit property in a city called Tacoma, which would be a lot closer for them to work, and they would house hack that property.

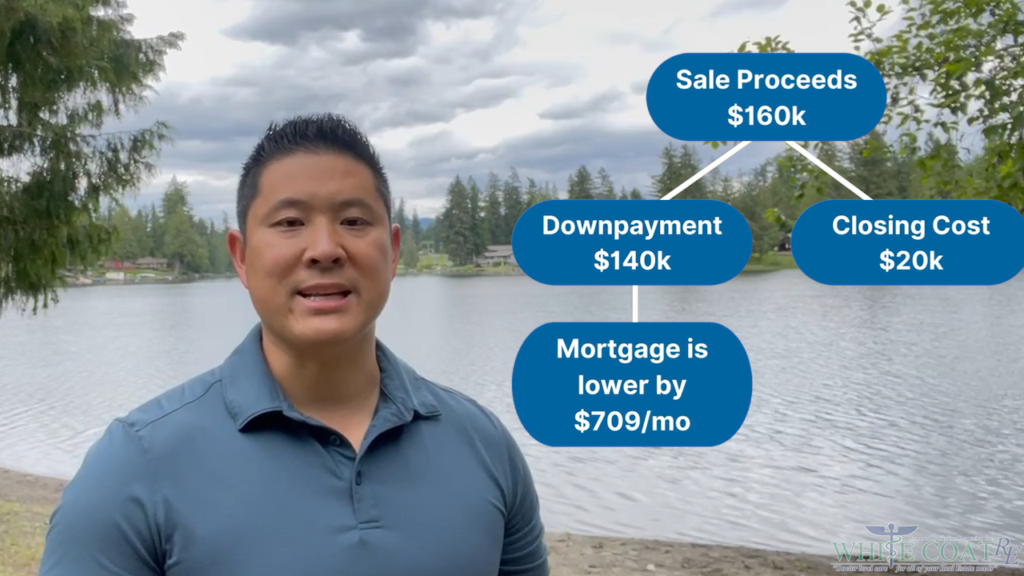

So we listed their home and we ended up getting multiple offers in the first week, the sale of their home netted them about $160,000 tax free because they’ve been living in the home for two of the last five years. That’s fantastic. Then, I found them another property a two unit property in central Tacoma right down the street from one of their favorite sushi restaurants, and a whole lot closer for them both to go to work.

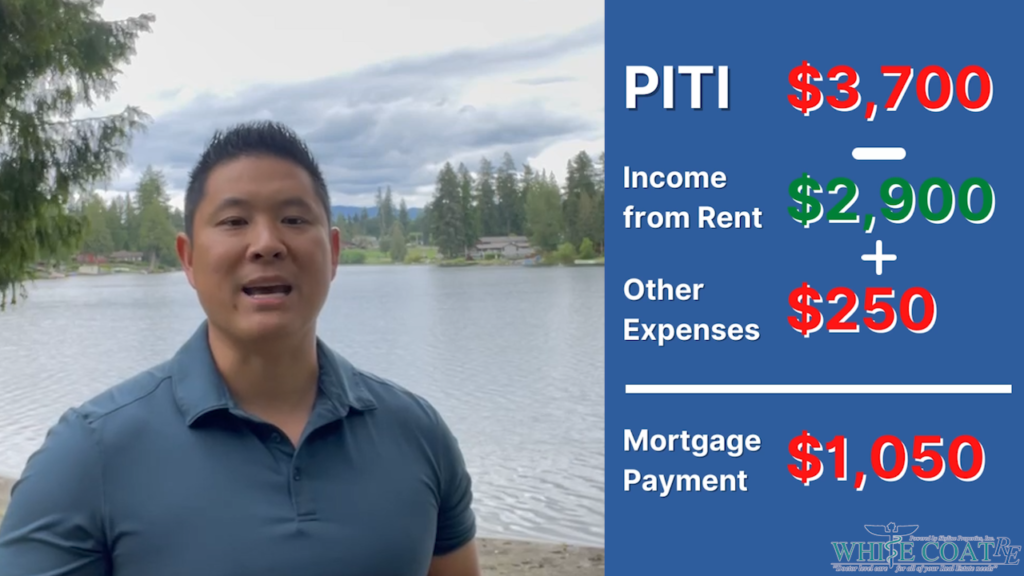

payment, or their PITL principal interest, taxes and insurance is right around $3,700 per month, after renting out the second unit for about $2,900 per month, and budgeting an extra $250 to the extra repair and maintenance and other expenses on that second unit. That brings her total housing costs to about $1, 050 a month.

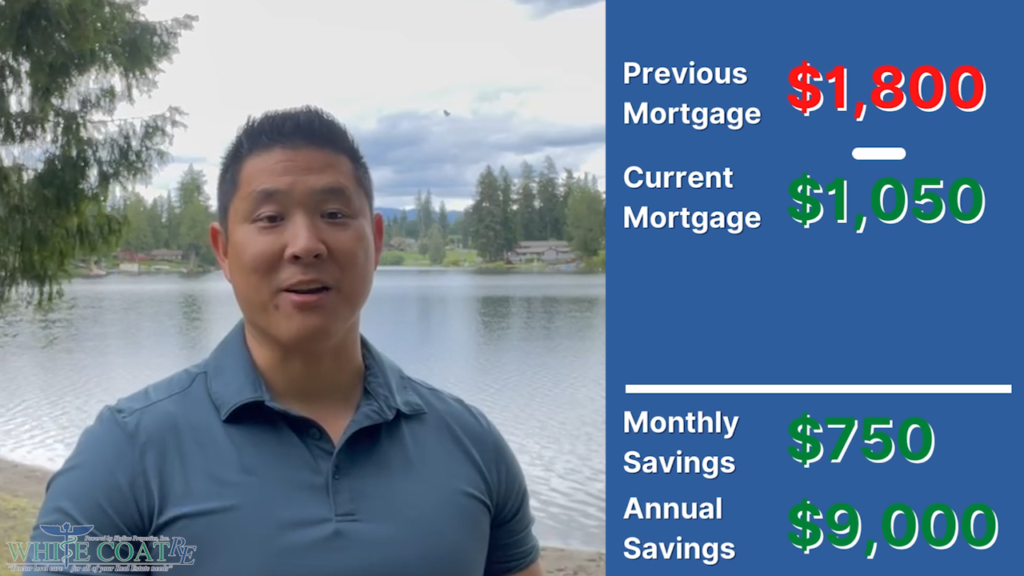

Compare that to their previous mortgage payment of about $1,800 per month. And this smart couple is going to save about $750 per month, or about $9,000 per year, that’s a lot of money Even better, because they use a VA loan to purchase their new property, they can buy that new property for zero down.

So they’ve got another $160,000 in their pocket, that they can then go out and invest into another rental property or real estate syndication or just throw it to the stock market into an ETF somewhere. Even if they just make a 7% return on that money, you would net them another $11,000 per year.

So all together between that $9,000 reduction in living expense, and the extra $11,000 in potential investment income. That’s about a $20,000 a year swing in their favor path a ton of cash, it’s a great way for them to jumpstart their real estate portfolio and then set themselves up for financial success.

Now some of you might be wondering, Hey, would this still have worked without a VA loan, like let’s say Greg and Stephanie didn’t actually have a VA loan, they had to come in and put 20% down so they couldn’t use the the sale proceeds from their previous home and put 20% down which would have lowered their mortgage payment on their new home by about $700 per month and a new PTI would be right around $3,000. So after adding in the $250 for repair and maintenance on the second unit and then subtracting out the rent from that renting out that second unit the same calculation we did before these guys would have saved roughly $1,450 per month, or about $17,000 per year, that’s still great savings, and would have set themselves up for financial success.