Okay, so you’ve decided to house hack. Now what? As discussed in my previous article, House Hacking: The Life Hack for Financial Freedom, house hacking is a great way to purchase both a home to live in and an investment at the same time. This also means the property has to simultaneously meet both your home ownership goals as well as your investing goals, which can be extremely challenging if the two conflict with one another. For example, the high rise condo with an ocean view (where you might really really want to live) may not make financial sense for an ideal house hack. Before running out to look at properties, take some time to think through your goals and determine your ideal (and realistic) criteria. Here are some of the key factors you should consider when developing your house hack strategy:

What kind of loan will you use?

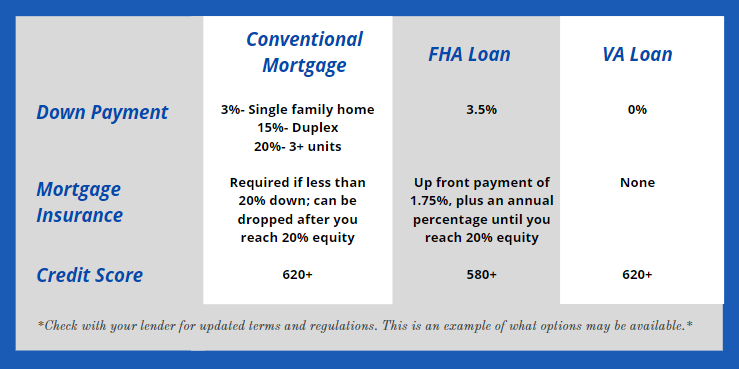

Once you’ve decided to house hack, start the process of getting pre-approved for a mortgage. Work with your lender to determine what kind of loan is best for you. Conventional mortgages and FHA or VA financing are some of the most popular choices, each with their own benefits. Looking at the amount of money you will need upfront for the down payment and closing costs, and understanding how large of a mortgage you qualify for, will help you determine your target price range.

While for multifamily properties require a higher down payment than FHA loans, there is no mortgage insurance premium (PMI) with a 20% down payment (and with a lower down payment, the PMI automatically falls off after you reach 20% equity in the property), which saves you quite a bit each month. In contrast, all FHA loans require PMI and there is an upfront payment as well as monthly premium. Even though conventional mortgages oftentimes have higher interest rates, the monthly payment may still be lower than an FHA loan payment because of the difference in PMI payments.

offer low down payment of 3.5% and are usually available to borrowers with lower credit scores (lenders often require 580+). FHA loans are also available sooner than conventional loans to borrowers who had a recent foreclosure or bankruptcy. Interest rates on FHA loans are often less than on conventional loans.

are available for 0% down with no PMI. Though there is technically no minimum credit score, many lenders prefer 620+. VA loans also typically offer lower rates than FHA or conventional.

Please note that loan guidelines are constantly changing so be sure to connect with a mortgage broker or lender who has experience in multifamily loans to help you understand the best loan for your situation. There are many ways to finance your house hack, from “buying down points” to paying off the mortgage insurance up front. Your lender should review your goals and point you toward the financing option that is most advantageous for your strategy.

What are your financial goals?

Before you begin searching for your new home, take the time to clearly define your priorities and plans. Outlining your financial goals, as well as your lifestyle goals, helps you recognize when you are looking at a worthwhile property.

Once you identify a potential property, consider two important questions:

- Will you be able to meet your financial goals? Analyze the income and expenses of the property, as well as your estimated mortgage payment, to understand what kind of cashflow (or reduction in living expenses) you can expect.

- Will the property provide cashflow even if you need to hire a property manager?

For many people, house hacking is a temporary part of an overall financial strategy. As life changes, does the property provide the financial means to move on while maintaining a worthwhile investment? Take a look at House Hack Your Way to Financial Freedom for a step-by-step guide to analyzing a potential house hack.

What is on your wish list?

Financials aside, you want to love the property you buy. After all, it will be home for at least the next year! Renting out individual rooms in your high-rise condo and sharing a kitchen and living spaces is vastly different from finding a tenant for the cozy cottage at the back of your acre lot. Consider what works for your lifestyle, your privacy preferences, and the size of your family.

- : As with any home purchase, consider your commute, proximity to family and friends, and any neighborhoods that you love.

- : Determine how many bedrooms, bathrooms and other dedicated spaces you need. How large is the place you are living now? Does that amount of space work for you or do you need something larger?

- : Decide if you want to share space with others or live in a self-contained unit. If you are comfortable renting out rooms in your home, you have the flexibility to look at single family homes. If you want a dedicated, private space, you can check out single family homes with mother-in-law suites or garage apartments, or focus on multi-family properties (duplex, triplex, quad).

- : Consider what you want in your own personal living space and whether you are comfortable making trade-offs. Do you want to be in the city or the suburbs? Is it important that there is a park nearby for your dog? Do want to be walking distance to restaurants and shopping or are you okay driving to these amenities?

- : Are you looking for something turnkey or are you willing to put in some “sweat equity” and “fix it up?” Keep in mind that turnkey properties sell for more because people pay a premium for convenience. If you purchase something that needs work, you may be able to build equity in the home through strategic updates and renovations.

Look at properties with the characteristics that meet your lifestyle, as well as your financial goals. Most mortgages have a 1 year owner-occupied clause, meaning you are committed to living at the property for at least that long.

The balance

The amount of emphasis that you put on maximizing your return on investment versus ensuring the home checks every one of your wants and needs is up to you. Set realistic expectations for the area you are targeting to help you determine how much multifamily properties are selling for. A good “investor friendly” real estate agent who understands both the financial metrics of a buy-and-hold investment property as well as the local real estate market can often serve as a sounding board and help you strike the balance. For more information on house hacking, including ideas of how to set yourself up for success, check out our free guide on house hacking!

Interested in the Tacoma, Washington market? I am your local multifamily investment specialist!

I sold more multifamily units than any other agent across Pierce and King counties in 2019-2020.

Give me a call today to discuss your house hacking dreams!

How Can We Help You?

We would love to hear from you! Please fill out this form, and we will get in touch with you shortly.